Executive Summary

The vacation rental website sector is poised for robust growth in 2024 fueled by strong travel demand and increased marketing investment by major players. Total marketing spend could reach $5 billion, up over 20% year-over-year. While Google and meta search ads will continue to dominate, streaming audio and connected TV are emerging as key brand-building channels. Niche sites will leverage social media to target unique audiences. As competition intensifies, smaller sites will likely be acquired. Overall, the sector will remain healthy as alternative accommodations gain share versus traditional hotels.

Introduction

The vacation rental marketplace has exploded thanks to leading websites like Airbnb, VRBO, and Booking.com. These platforms have made finding and booking short-term rentals seamless for consumers while providing homeowner hosts access to a lucrative new income stream. The sector weathered the pandemic downturn through rapid innovation and is now poised for a growth inflection heading into 2024.

Key Drivers

Several factors will fuel growth and evolution in the vacation rental website sector in 2024:

-

Continued strong travel demand as pandemic effects fully recede

-

Work flexibility enabling more frequent, shorter trips

-

Homeowners seeking income supplement with short-term rentals

-

Platform innovations enhancing user experience on both sides

-

Major platforms ramping up performance and brand marketing

-

Niche players attracting specific traveler segments

-

Industry consolidation through mergers and acquisitions

Forecasted Growth for 2024

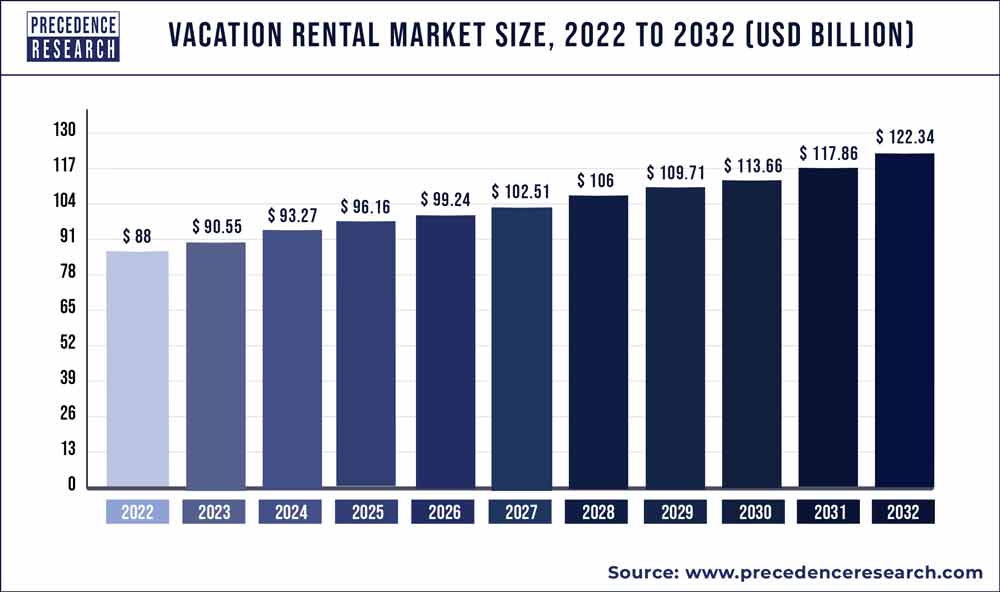

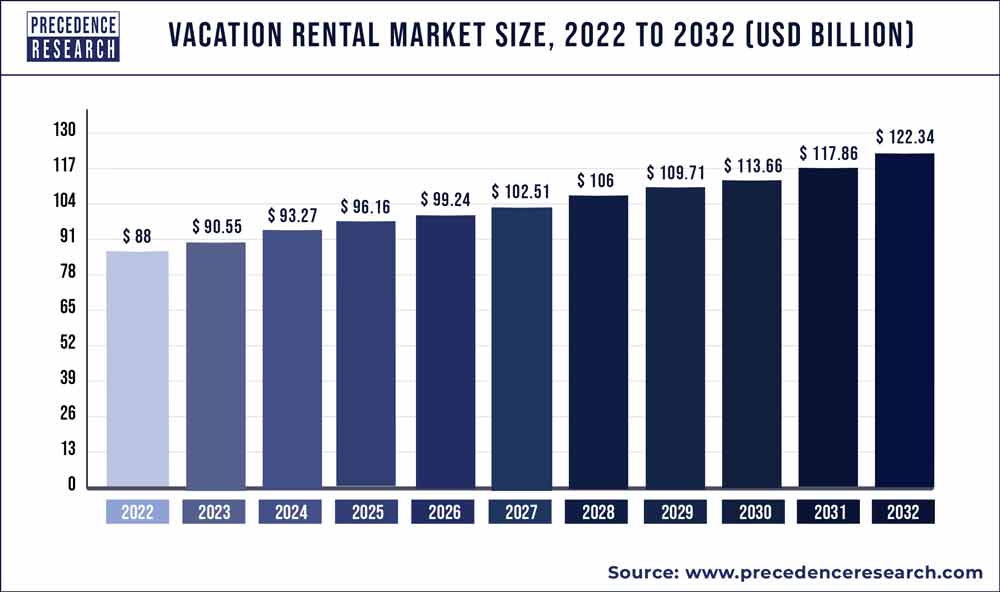

According to market research firm IBISWorld, global vacation rental website revenue is projected to grow by 8% in 2024 to reach $17 billion. This forecast factors in sustained consumer demand for alternative accommodations, new supply additions, and increased monetization by platforms. Europe remains the largest market, but Asia Pacific is seeing the fastest growth. The US market size is estimated at around $4.2 billion.

Competitive Landscape

While Airbnb has the highest brand equity and bookings volume, the competitive landscape has expanded well beyond just VRBO. New models continue emerging to serve unique audience segments.

Airbnb: The clear leader, Airbnb offers over 6 million listings worldwide. Its brand has become synonymous with short-term rentals for many. Continued investments in trust and safety ensure mainstream appeal.

VRBO: A pioneer along with Airbnb, VRBO leans towards professionally managed properties. It retains brand equity among family/group travelers. Integration with Expedia provides a scale advantage.

Booking.com: The world’s largest accommodations site recently jumped into vacation rentals as an add-on option for its hotel and B&B audience. Leverages massive reach to cross-sell.

Vacasa: Originally a rental management company, Vacasa combines its professionally managed portfolio with a consumer booking platform to provide end-to-end control.

Karta: Focused on consistency with apartment-style units designed expressly for short-term stays. Appeals to millennial business travelers with a hotel-like platform.

Marketing Budgets and Priorities in 2024

To drive growth amid increased competition, the major vacation rental websites are all ramping up marketing investment. Total marketing spend in the sector could reach $5 billion in 2024, up from around $4 billion today. Digital channels will continue to dominate, but TV and audio brand advertising will gain share to raise awareness and consideration.

Key marketing priorities include:

-

Paid search marketing: Google AdWords campaigns will remain a primary channel for driving direct bookings due to measurable ROI.

-

Meta search advertising: Platforms like TripAdvisor, Trivago and Kayak are crucial platforms where consumers comparison shop. Sites will aggressively bid for prominence.

-

Retargeting: Leveraging cookies and consumer data, platforms will re-engage users who browsed listings or began bookings through tailored ads and offers.

-

Streaming audio: Podcast and music streaming ads are gaining share as awareness builders, especially among younger demographics.

-

Connected TV: Sites will buy commercial spots on popular travel, news and entertainment programming to tell their brand stories.

-

Social media: Niche sites use Facebook and Instagram ads to target unique demographics like families, adventure travelers, or pet owners.

-

Loyalty partnerships: Co-branding with airlines, hotels and financial service providers allow gaining customers through integrated rewards programs and elite benefits.

Emerging Differentiation Strategies

With marketing channels converging, platforms are pursuing several strategies to stand apart in 2024:

-

Supply exclusivity: Offering one-of-a-kind properties provides differentiation. Airbnb Plus highlights higher-end listings. VRBO focuses on professionally managed homes.

-

Unique experiences: Curating local experiences beyond just lodging attracts guests seeking adventure and cultural immersion. Airbnb Experiences has expanded rapidly.

-

Enhanced user experience: Investments in mobile apps, support services and seamless self-service tech like keyless entry improves satisfaction on both sides.

-

Targeted loyalty programs: VRBO, Vacasa and Karta are building loyalty programs aimed at their core customer segments to drive repeat bookings.

-

Consistent quality: Operators like Sonder and Vacasa with centralized property management can offer guaranteed standards and hotel-like reliability.

-

Localization expertise: Multilingual sites, location-specific supply acquisition, and partnerships with regional OTAs makes penetration into new markets easier.

Industry Consolidation

With platforms competing more directly, mergers and acquisitions are accelerating as smaller niche sites get acquired. Airbnb acquired HotelTonight to boost last-minute bookings. VRBO often acquires vacation rental managers to expand regional supply. Industry rollups are also occurring, with companies amassing portfolios of rental brands. This consolidation will put further pressure on independent websites. Only highly targeted sites like Karta, AirBnB, HomeToGo with loyal communities are likely to remain independent in 2024.

Key Risks

While the outlook is strongly positive overall, risks do exist:

-

Resurgence of COVID - further outbreaks and variants could impact travel demand and reintroduce restrictions on short-term rentals.

-

Host saturation - an oversupply of listings from individual investors could drive down occupancy rates.

-

Commoditization - platforms may struggle to differentiate as offerings converge. Relying too much on performance marketing could erode brand equity over time.

-

Regulatory changes - many jurisdictions are imposing stricter regulations around short-term rentals, from taxes to zoning, potentially restricting supply and margins.

Outlook for 2024

Vacation rental websites are well positioned to see strong growth in 2024. As travel demand remains robust post-pandemic, alternative accommodations will continue gaining share. Major players will use their sizable marketing budgets to attract customers across both demand generation and direct booking channels. Consolidation will remove smaller independents with undifferentiated offerings. Nimble companies who provide unique value propositions should thrive within this dynamic, expanding ecosystem.

|